Forex Brokers: Discover the Right Broker for Your Trading Design

Forex Brokers: Discover the Right Broker for Your Trading Design

Blog Article

Deciphering the Globe of Foreign Exchange Trading: Discovering the Relevance of Brokers in Handling Threats and Guaranteeing Success

In the detailed realm of forex trading, the duty of brokers stands as a crucial component that often remains shrouded in enigma to several hopeful traders. The importance of brokers surpasses plain deal facilitation; it includes the realm of threat administration and the overall success of trading undertakings. By leaving brokers with the job of navigating the intricacies of the forex market, investors can possibly unlock a world of opportunities that could otherwise continue to be elusive. The intricate dance in between brokers and investors unveils a symbiotic connection that holds the key to untangling the secrets of rewarding trading ventures.

The Duty of Brokers in Forex Trading

Brokers play an essential function in foreign exchange trading by providing necessary solutions that assist investors take care of dangers efficiently. These monetary intermediaries function as a bridge in between the investors and the foreign exchange market, offering a variety of solutions that are important for browsing the intricacies of the forex market. Among the key features of brokers is to give investors with access to the marketplace by assisting in the implementation of professions. They provide trading platforms that allow traders to purchase and sell money sets, providing real-time market quotes and making sure speedy order implementation.

Furthermore, brokers offer leverage, which enables investors to control bigger settings with a smaller sized quantity of funding. While leverage can intensify revenues, it likewise enhances the potential for losses, making threat administration essential in foreign exchange trading. Brokers give risk management devices such as stop-loss orders and limitation orders, allowing investors to set predefined leave points to minimize losses and safe earnings. Additionally, brokers supply educational sources and market analysis to assist investors make notified decisions and create efficient trading methods. Overall, brokers are vital companions for traders looking to navigate the forex market successfully and manage threats efficiently.

Risk Monitoring Techniques With Brokers

Offered the important duty brokers play in promoting access to the foreign exchange market and supplying threat monitoring tools, recognizing reliable techniques for taking care of risks with brokers is crucial for effective foreign exchange trading. By spreading investments throughout different currency pairs and asset classes, traders can decrease their direct exposure to any single market or tool. Keeping a trading journal to track performance, evaluate past trades, and recognize patterns can assist traders improve their approaches and make more enlightened decisions, ultimately enhancing danger administration practices in forex trading.

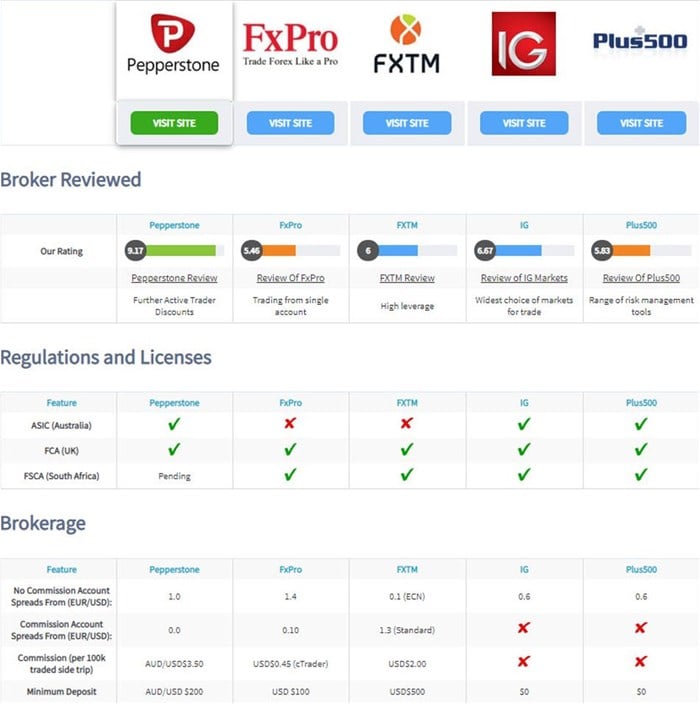

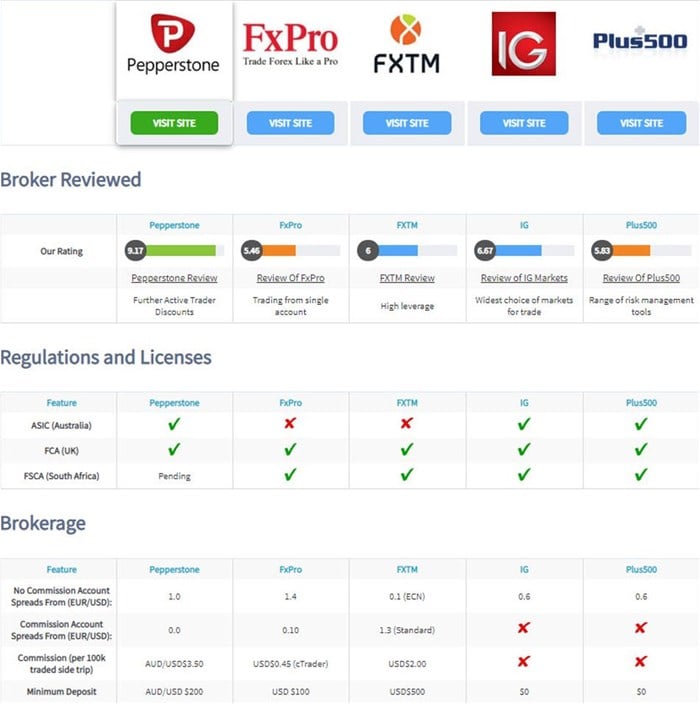

Broker Selection for Trading Success

Selecting the right broker is critical for achieving success in foreign exchange trading, as it can significantly influence the total trading experience and end results. When selecting a broker, several crucial variables ought to be thought about to make sure a worthwhile trading journey. One vital aspect to assess is the broker's governing conformity. Dealing with a regulated broker provides a layer of security for investors, as it makes certain that the broker operates within established criteria and guidelines, therefore reducing the threat of scams or malpractice.

In addition, traders need to evaluate the broker's trading system and tools. An user-friendly system with advanced charting tools, quickly trade execution, and a variety of order types can improve trading performance. In addition, taking a look at the broker's customer support solutions is important. Trigger and dependable consumer support can be very useful, especially during unpredictable market problems or technical problems.

Furthermore, traders must assess the broker's cost framework, consisting of spreads, compensations, and any surprise charges, to understand the cost effects of trading with a certain broker - forex brokers. By thoroughly assessing these variables, investors can choose a broker that straightens with their trading objectives and sets the phase for trading success

Leveraging Broker Knowledge for Profit

How can traders properly harness the experience of their selected brokers to make the most of profitability in foreign exchange trading? Leveraging broker competence for earnings calls for a strategic strategy that entails understanding and utilizing the solutions offered by the broker to enhance trading outcomes. One vital method to leverage broker knowledge is by making the most of their study and evaluation devices. Lots of brokers provide accessibility to market insights, technical evaluation, and economic schedules, which can assist investors make educated decisions. By staying educated about market fads and occasions via the broker's sources, traders can identify profitable chances and alleviate dangers.

Furthermore, traders can gain from the guidance and assistance go to this site of experienced brokers. Establishing a great relationship with a broker can bring about customized suggestions, profession suggestions, and threat monitoring techniques tailored to individual trading designs and objectives. By interacting routinely with their brokers and looking for input on trading strategies, traders can take advantage of expert knowledge and improve their total performance in the forex market. Eventually, leveraging broker know-how commercial entails active engagement, constant knowing, and a collaborative technique to trading that maximizes the possibility for success.

Broker Aid in Market Analysis

Broker aid in market evaluation expands beyond simply technological analysis; it also encompasses basic analysis, sentiment analysis, and threat administration. By leveraging their expertise and accessibility to a large range of market information and research devices, brokers can help investors navigate the complexities of the forex market and make knowledgeable decisions. Additionally, brokers can supply timely updates on economic occasions, geopolitical advancements, and other elements that may influence currency costs, allowing traders to stay ahead of market fluctuations and readjust their trading settings appropriately. Ultimately, by utilizing broker help in market evaluation, traders can improve their trading performance and raise their chances of success in the competitive forex market.

Verdict

In final thought, brokers play a crucial role in forex trading by managing threats, giving knowledge, and assisting in market analysis. Choosing the best broker is important for trading success and leveraging their knowledge can cause earnings. forex brokers. By utilizing danger management strategies and functioning very closely with brokers, traders can browse the intricate world of foreign exchange trading with confidence and increase their chances of success

Given the crucial function brokers play in promoting access to the foreign exchange market and providing danger monitoring devices, comprehending effective approaches for managing dangers with brokers is necessary for effective forex trading.Choosing the appropriate broker is extremely important for attaining success in foreign exchange trading, as he said it can dramatically impact the total trading experience and results. Working with a managed broker gives a layer of protection for traders, as it makes sure that the broker runs within set standards and standards, therefore decreasing the threat of fraudulence or malpractice.

Leveraging broker experience for profit needs a critical approach that involves understanding and utilizing the solutions offered by the broker to boost trading end results.To effectively capitalize on broker experience for profit in foreign exchange trading, investors can depend on Extra resources broker support in market evaluation for educated decision-making and danger reduction methods.

Report this page